AdvisorBridge Custom Due Diligence Process

We guide you through the proven CPE selection process

AdvisorBridge’s CPE due diligence process has successfully helped over 400 Financial Advisors make a successful transition to grow their business and better serve their clients.

When your business has partnered with the right Broker-Dealer/custodian your firm can grow to the next level both top line production and net profit and most importantly offer your clients a better experience and service.

-

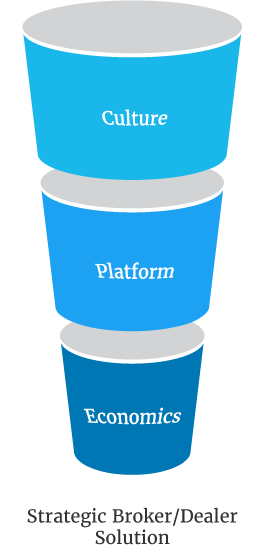

Culture

Culture is often the number one reason why Financial Advisors become unhappy and begin the thought process of leaving their Broker Dealer or Custodian. This shift happens for various reasons. Often, it’s because of a merger or a buyout and this ignites a sudden change in the firms’ culture. It’s no longer the firm you first joined. Culture is where we start the due diligence process. All Broker dealers are eager to recruit you but the firm’s core culture must be vetted for a long- lasting successful business relationship.

-

Platform

Does the new potential Broker-Dealer/Custodian have the right products, platforms, technology and compliance for your business and your clients’ needs.

Your firm needs the right tools to help you grow to the next level of production. The internal fees must be in line with your business model. For example, you need the right options for how you charge your clients. The compliance guidelines must also be in lockstep with your firm. Compliance should partner with your business not prohibit you from business.

-

Economics

The economics need to make sense. Transitioning your business is a substantial business decision. Some Broker Dealers are offering big Transition compensation but at what cost? Some offers sound intriguing but does it make sense a few years into your new relationship.